Finance Information

Reports and Resources

The Finance Department supports the teaching, learning, research and outreach mission of The College of St. Scholastica by providing strategic, fiscal, operational and compliance oversight.

Tax Credit Information

American Opportunity and Lifetime Credit

This page is a resource for The College of St. Scholastica students and their parents who may be eligible for a tax credit under the Taxpayer Relief Act of 1997 (TRA97). TRA97 created two education tax credits for students and families beginning in 1998. The credits have been modified and extended by The American Recovery and Reinvestment Act (ARRA) & Tax Relief and Job Creation Act of 2010:

- The American Opportunity Credit provides up to $2,500 per student for qualified tuition and related expenses for the first four years of postsecondary education. To be eligible, students must be enrolled at least half-time in a degree or certificate granting program. The American Opportunity Credit is available for expenses paid on or after January 1 of the tax year.

- The Lifetime Learning tax credit is more broadly applicable to any postsecondary education to acquire or improve job skills. It provides a credit equal to 20 percent of qualified expenses of no more than $10,000 per taxpayer (i.e., family).

Eligible higher education institutions will now be required to file information reports with the IRS, and furnish statements to taxpayers (1098-T) on all students for whom they receive tuition payments.

What’s New

The American Opportunity Tax Credit modified the existing Hope Credit for tax years 2009 and 2010 under ARRA. The credit was extended to apply for tax years 2011 and 2012 by the Tax Relief and Job Creation Act of 2010. The new credit makes the Hope Credit available to a broader range of taxpayers, including many with higher incomes and those who owe no tax. It also adds required course materials to the list of qualifying expenses and allows the credit to be claimed for four post-secondary education years instead of two. Many of those eligible will qualify for the maximum annual credit of $2500 per student. This credit equals 100% of the first $2,000 and 25% of the next $2,000 of qualified expenses paid for each eligible student. The amount of your credit for 2011 is gradually reduced (phased out) if your Modified Adjusted Gross Income (MAGI) is between $80,000 and $90,000 ($160,000 and $180,000 if you file a joint return). You cannot claim a credit if you MAGI is $90,000 or more ($180,000or more if you file a joint return). For additional instructions please go to IRS Publications.

The College of St. Scholastica does not provide personal tax advice. To determine your eligibility for a higher education tax credit, please contact the IRS or your personal tax advisor.

Tax Relief Act of 1997

What are the Tax Education Credits that I’m hearing about?

In August of 1997, President Clinton signed the Taxpayer Relief Act of 1997 (TRA97) which provides a number of tax benefits to help students and their families pay for higher education. Two of the benefits include the Hope Scholarship and the Lifetime Learning Credit.

How does that affect me?

You or your parents may be eligible to claim a credit against your federal income taxes. That means you may not have to pay as much in federal income tax.

Can you explain the difference between the Hope Scholarship and Lifetime Learning Credits?

The Hope Scholarship provides a tax credit of up to $2,500 per student for qualified tuition and related expenses for the first two years of post secondary enrollment. A student must be enrolled at least half-time (6 credits) in a degree or certificate program. The Hope credit is available for expenses paid on or after January 1, 1998 for academic periods beginning on or after that date. The taxpayer is eligible for a tax credit equal to 100% of the first $2,000 paid for qualified tuition and fees (less grant aid) and 25% of the next $2,000 for a total tax credit of $2,500 maximum.

The Lifetime Learning Credit provides a tax credit of up to $2,000 per family for qualified tuition and related expenses. The tax credit eligibility covers a wider range of students. A student needs only be enrolled in a degree or certificate program or taking undergraduate or graduate classes to acquire or improve job skills. The Lifetime Learning Credit is available for expenses paid on or after July 1, 1998 for academic periods beginning on or after that date. The taxpayer is eligible for a tax credit equal to 20% of the first $5,000 paid for qualified tuition and fees (less grant aid) for a total of $1,000.

Claiming the Credits

The Hope Credit is a per-student credit. If more than one student in a family meets the eligibility requirements, the parents are allowed to claim a credit of $2,500 for 2009 and 2010 for each eligible student. The Lifetime Learning Credit is a per-taxpayer credit. Regardless of the number of students in the family, the maximum Lifetime Learning Credit that may be claimed on a tax return is $2,000.

The two credits are mutually exclusive for the same student in the same tax year. If a parent pays tuition for a student and claims the Hope Credit against that tuition payment for that year, the parent may not claim a Lifetime Learning Credit against any part of the same tuition payment for that same year, even if the payment is more than the amount the credit uses as its tuition threshold. If a parent pays tuition for two students in the same year, one of whom is eligible for the Hope Credit and one of whom is not, the taxpayer may claim the Hope Credit for the payment made on behalf of the one eligible student and the Lifetime Learning Credit for the payment made on behalf of the other eligible student, all on the same tax return.

Will the College tell me the specific dollar amount of qualified tuition and fees?

Yes. Box 2 on the 1098-T form will display the qualified tuition and fees and box 5 will display the grants and scholarships you received for the calendar year.

What is the College going to send me?

By January 31, the College is required to send a tax form (1098-T) to all students, excluding international students. The College is also required to report this same information to the IRS by February 28. This form will include:

- Name, address, and taxpayer identification number of the College

- Name, address, and social security number of the student

- An indicator of whether the student was enrolled at least half-time during any academic period

- An indicator of whether the student was enrolled as a graduate student

- A contact person at the college where students or parents can call with questions

- Box 2 will include an amount for qualified tuition and fees

- Box 5 will include grants and scholarships

1098-T Frequently Asked Questions (FAQs)

Before You Begin

What is a 1098-T?

IRS Form 1098-T (Tuition Statement) is an informational statement intended to serve as a reference for the taxpayer. The College prepares the form for students with qualified tuition and related expenses with U.S. citizenship or permanent resident status during the reported tax year and may be used to help determine if you are eligible to claim educational related tax credits.

Do I need to use the 1098-T form when filing my taxes?

There is no need to attach Form 1098-T to your tax return. There is no IRS requirement that you must claim the tuition and fees deduction or an education credit. Claiming education tax benefits is a voluntary decision for those who may qualify.

Who is eligible to receive a 1098-T?

Colleges and universities must file Form 1098-T for any individual enrolled for any academic period and for whom the institution receives payment of qualified tuition and related expenses during the calendar year.

Who is NOT eligible to receive a 1098-T?

- Students whose entire qualified tuition and related expenses were waived or paid for with a scholarship

- Students whose entire qualified tuition and related expenses were paid under a “formal billing arrangement” where the institution:

- Bills only an employer or governmental entity, and

- Does not maintain a separate financial account for the student

- Nonresident aliens, except upon request

- Courses for which no academic credit is offered, even if the student is otherwise enrolled in a degree program

What are “qualified” versus “non-qualifying” expenses?

Eligible or Qualified Expenses Include

Eligible tuition including the following:

- Graduate

- Undergraduate

Eligible fees including the following:

- Technology fees

- Student activity fees

- Course/program fees

Non-Qualified Expenses Include

- Housing

- Meal Plans

- Books

- Transportation

- Insurance

- Medical expenses (including student health fees)

- Personal, living or family expenses.

When will my IRS Form 1098-T be available?

Form 1098-T will be mailed to the student no later than Jan. 31. An electronic copy is available to you on my.css.edu.

What is the timeline for the 1098-T?

The 1098-T form contains information pertaining to the calendar year (Jan. 1-Dec. 31).

Why didn’t I receive a 1098-T form?

There are several reasons why a 1098-T form may not be generated or received:

- If you did not pay any qualified charges during the previous calendar year

- If you are classified as a Non-Resident Alien on the CSS student record

- Your 1098-T form was sent to an old or incorrect address

Form 1098-T Explained

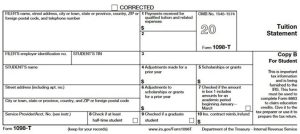

A sample 1098-T form is shown below for your reference.

Box 1

Shows the total amount of payments received for qualified tuition and related expenses from all sources during the tax year. The amount reported is the total amount of payments received less any reimbursements or refunds made during the tax year that relate to the payments received for qualified tuition and related expenses during the same tax year. The amount reported is not reduced by scholarships and grants reported in Box 5.

Box 2

Effective in tax year 2018, per federal regulation, this box is no longer used and will be blank.

Box 3

Shows whether your educational institution changed its reporting method.

Box 4

Shows the amount of any adjustments made for qualified tuition and related expenses that were reported on a prior year 1098-T.

Box 5

Shows the amount of financial aid that was applied to your student account during the tax year (January–December), regardless of the semester the financial aid was awarded.

Box 6

Shows the amount of any reduction to the amount of scholarships or grants that were reported for any prior year after 2002.

Box 7

This box is checked if any payments received for qualified tuition and related expenses reported for the reported tax year relate to an academic period that begins in the following tax year.

Box 8

If this box is checked, the student was at least half-time during any academic period in the reported year.

Box 9

If this box is checked, then the student is a graduate student at any time during the reported year.

Box 10

N/A

Frequently Asked Questions

1. Why is Box 1 blank?

Box 1 on your 1098-T may be blank or zero for the following reason:

Spring qualified tuition and related expenses are billed in the tax year preceding the start of classes and reporting on the Form 1098-T in the tax year before the semester begins.

Since the qualified tuition and related expenses were reported in the preceding tax year, payment for these charges are not included in Box 1 to avoid duplicate reporting to the IRS.

Note: Refer to question on how payments are applied for See question about how payments are applied for 1098-T reporting.

2. Why does it appear that there is missing information for one or more semesters I attended during the year reported?

Please be advised that amounts paid do not represent amounts billed by the College during the calendar year. The amount in Box 1 represents amounts paid and posted to your student account during the calendar year the monies were received and there is no consideration given to when classes are attended.

Example: Students who are enrolled for the upcoming spring term before Dec. 31 will normally see spring charges on their account in December. Payments made for those spring charges before Dec. 31 will be included in Box 1 up to the qualified tuition and fees on their student account by Dec. 31.

3. What if the amount in Box 5 exceeds the amount in Box 1?

The amount of scholarships/grants can be greater than qualified tuition and related expenses reported in Box 1. The 1098-T form is not an indicator of income. IRS Form 1098-T contains information to assist you in determining if you are eligible to claim educational related tax credits. It is the sole responsibility of the student to determine if any portion of received scholarships, fellowships, or grants are subject to tax.

4. Is the Federal Emergency Relief Grant to Students (HEERF) payments reported on the 1098-T?

Per IRS guidance, if you received the Federal Emergency Relief Grant to Students (HEERF) funding during 2021, the amount received is not reported on the 1098-T.

5. How are payments applied for 1098-T reporting?

Payments are applied first to any prior term balances, then to qualified tuition and related expenses and then to nonqualified expenses such as room and board. Payments include all sources (personal payments, scholarships, grants, and loans) and are reduced by any refunds processed during the calendar year.

Students who are enrolled for the upcoming spring term before Dec. 31 will normally see spring charges on their account in December. Payments made for those spring charges before Dec. 31 will be included in Box 1 up to the qualified tuition and fees on their student account by Dec. 31.

The allocation of payments to specific charges in your Banner student account may differ depending on the payment source.

6. Why don’t the numbers on Form 1098-T equal the amounts I paid to CSS during the year?

There are potentially many reasons for this discrepancy.

First, the amount in Box 1 only represents amounts paid for qualified tuition and related expenses (QTRE) and does not include payments made for room and board, insurance, health service fees, or parking which, though important, are not considered mandatory education expenses for tax purposes.

Secondly, Form 1098-T reports amounts that the student paid in a certain year, and the pay date does not necessarily correspond to the dates that the classes were attended. For example, tuition for the spring semester is billed and reported in the tax year prior to the start of classes, so a student may have paid tuition for the spring semester in the tax year prior to when classes begin.

7. Does any of the information on the 1098-T correlate to any amounts I can claim on my tax returns?

No, they will not. Only amounts paid for qualified tuition charges are reported on the 1098-T form. The taxpayer will need to determine the amount of income to report on their tax returns for their own records.

8. What if I still have questions? Who can I contact?

Please be advised: The College of St Scholastica is prohibited from providing legal, tax, or accounting advice to students and is not responsible for use of this information. Additional 1098-T questions should be directed to your professional tax advisor.

9. Additional Resources

Requests for Bid

Current Invitations to Bid: